Investors, traders, and market watchers often turn to online platforms to understand sentiment before making decisions — and Stock Twits is one of the most popular places to do that. If you’ve searched for stock twits nwbo, you’re likely trying to gauge how traders view Northwest Bio stock (ticker: NWBO) based on real-time social sentiment and chatter.

StockTwits has become a hub for quick insights, opinions, and trend signals from other traders. But interpreting social sentiment successfully requires context, a bit of strategy, and smart risk awareness. This complete guide breaks down everything you need to know about stock twits nwbo — from what StockTwits is, how NWBO appears there, how sentiment influences trading decisions, and how to separate signal from noise.

What Is StockTwits?

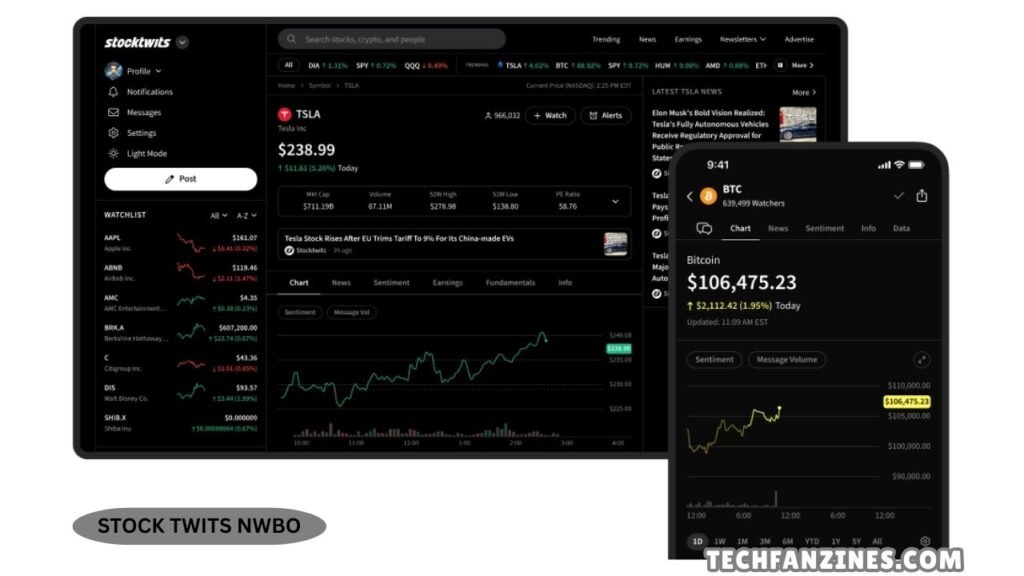

StockTwits is a social network designed specifically for traders and investors. It functions like a specialized version of a social feed where users share messages, charts, tickers, reactions, and sentiment indicators about stocks, crypto, and markets.

On StockTwits, users can:

• Follow stock tickers (like NWBO)

• See real-time chatter from traders

• Share short messages (called “twits”)

• Use emojis and sentiment tags (e.g., bullish 📈 or bearish 📉)

• Spot trending tickers and hot topics

For many traders, StockTwits complements chart analysis with crowd-driven sentiment data — kind of like reading the room for what other investors think right now.

Who Is NWBO?

The ticker NWBO refers to Northwest Biotherapeutics, Inc., a biotech company involved in developing immunotherapy and cancer treatment technologies. Biotech stocks often attract high social interest because:

• They can be volatile

• Clinical trial news impacts share prices

• FDA announcements often move markets

• Retail traders often discuss biotech catalysts

Because of this, stock twits nwbo searches often spike around news events, rumors, or trading activity tied to the company.

Why People Follow NWBO on StockTwits

There are several reasons traders monitor stock twits nwbo:

• Real-time sentiment: See how others feel about NWBO’s short-term direction.

• News reaction: Get crowd reactions before official news spreads widely.

• Trend spotting: People often look for early trend signals before price moves.

• Buzz tracking: High volume of “twits” can correlate with heightened trading volume.

On StockTwits, traders often share price levels, technical indicators, and conviction — which can be informative when combined with your own analysis.

How Social Sentiment Works on StockTwits

Sentiment on StockTwits comes primarily through short messages and emojis. Users often tag tickers with:

• 📈 (bullish)

• 📉 (bearish)

• 💬 (discussion)

• 🔥 (hot)

• 💎🙌 (diamond hands, holding strong)

• 🚀 (going up)

Strong sentiment in one direction doesn’t guarantee price action — but it can indicate trader psychology. For example, a flurry of bullish messages may show optimism around a news event. Conversely, bearish sentiment can show fear or profit-taking.

Social sentiment isn’t a standalone indicator, but when paired with technical analysis and fundamental research, it can add valuable context.

Typical Patterns Traders Watch on StockTwits

When people look up stock twits nwbo, they may be watching for patterns like:

• Spike in TWITS volume: More chatter often means higher attention and potential volatility.

• Bullish/Bearish ratio: A preponderance of bulls vs bears can influence short-term trends.

• Catalyst-driven spikes: Sentiment shifts after news releases or filings.

• Consistent sentiment shifts: Long-term bullishness or bearishness may reflect conviction.

These patterns help traders frame the mood around NWBO and consider how it fits within technical and fundamental analysis.

Risks of Relying Solely on Social Sentiment

While StockTwits can be insightful, relying solely on sentiment carries risks:

• Noise instead of signal: Not all opinions are informed or reliable.

• Herd behavior: Traders can amplify momentum irrationally.

• Rumors spread quickly: Unverified chatter can mislead without confirmation.

• Volatility spikes: Emotional reactions may cause sharp price swings.

Sentiment should inform decisions, not drive them. Always combine social data with chart analysis, news verification, and risk management.

How to Use StockTwits for NWBO Wisely

Here are practical ways to incorporate stock twits nwbo data into your strategy:

1. Confirm with Fundamentals

Check company filings, news releases, and clinical data before acting on sentiment.

2. Use Technical Indicators

Combine sentiment with RSI, trendlines, support/resistance levels, and volume.

3. Monitor Sentiment Shifts

Sudden sentiment changes may signal an impending move — but look for confirmation.

4. Use Alerts

Set alerts for ticker mentions or sentiment surges to stay informed in real time.

5. Manage Risk

Always set stop-loss levels and protect capital — sentiment can flip quickly.

Using StockTwits correctly means contextualizing the chatter, not trading solely on it.

Common Scenarios Where Sentiment Shifts Matter

Here’s how traders often react to sentiment shifts around stock twits nwbo:

• Positive News Catalyst: A strong clinical result or regulatory update sparks bullish sentiment and volume.

• Mixed Market Conditions: Broader market volatility can crowd sentiment, making NWBO’s chatter swirl.

• Rumor Spikes: Unverified commentary drives short-term moves before reality sets in.

• Profit-taking Signals: Rapid price run-ups lead to bearish sentiment as traders lock in gains.

These scenarios show why sentiment can be dynamic and change rapidly.

Pros and Cons of Using StockTwits for NWBO

Pros

• Real-time crowd data

• Instant reactions to headlines

• Community insights and trend visibility

• Quick gauge of market sentiment

Cons

• Noise and misinformation

• Emotional bias influences chatter

• Not a standalone trading tool

• Requires cross-checking

Sentiment is powerful when used responsibly — as one part of a broader analysis framework.

Final Thoughts on Stock Twits NWBO

The phrase stock twits nwbo reflects a common modern approach to investor research — blending social sentiment with technical and fundamental analysis. StockTwits is a powerful platform for capturing trader mood in real time, but it should never replace comprehensive due diligence.

If you watch stock twits nwbo to stay informed:

• Understand the context behind messages

• Combine sentiment with solid research

• Watch for catalyst events

• Protect your capital with sound risk strategies

Sentiment adds color to data — but the decision should be rooted in disciplined research.

Also read: Is Fisher Investments Any Good – Comprehensive Review & Investor Guide